Next Program

Tuesday, May 12, 2026

Taming the IRS Bot: Learn the IRS’s Automated Collection System

Program Archives

QAS Self Study, Resources & Transcripts

Each program is available in our archives 24 hours after the live broadcast.

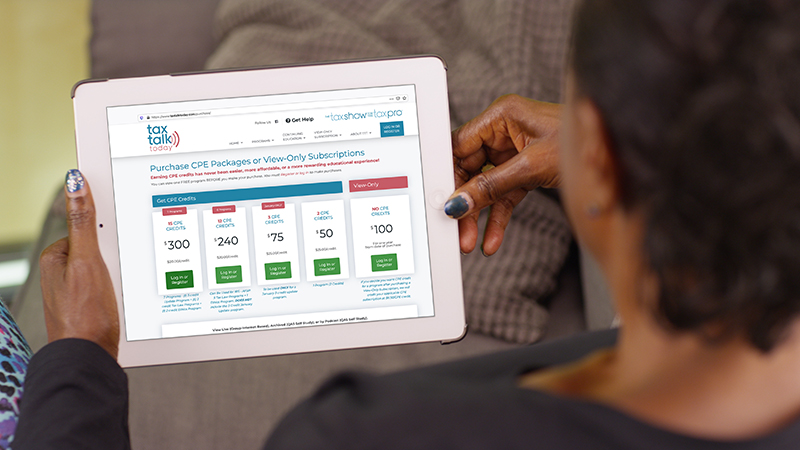

CPE & View Packages

CPE Packages or View-Only Subscriptions

You can view one FREE program BEFORE you make your purchase.

Do you have a question during a live program?